All Categories

Featured

Table of Contents

Keep in mind, nonetheless, that this doesn't claim anything about adjusting for inflation. On the bonus side, even if you assume your option would be to purchase the stock exchange for those seven years, and that you would certainly get a 10 percent yearly return (which is much from specific, especially in the coming decade), this $8208 a year would be even more than 4 percent of the resulting small stock value.

Example of a single-premium deferred annuity (with a 25-year deferment), with 4 settlement alternatives. Courtesy Charles Schwab. The month-to-month payment here is highest for the "joint-life-only" choice, at $1258 (164 percent higher than with the prompt annuity). The "joint-life-with-cash-refund" alternative pays out only $7/month less, and guarantees at the very least $100,000 will certainly be paid out.

The way you purchase the annuity will certainly identify the solution to that question. If you acquire an annuity with pre-tax bucks, your premium lowers your taxable revenue for that year. According to , purchasing an annuity inside a Roth strategy results in tax-free payments.

Immediate Annuities

The consultant's primary step was to develop a comprehensive monetary strategy for you, and after that describe (a) how the proposed annuity matches your overall plan, (b) what options s/he considered, and (c) how such choices would certainly or would certainly not have actually led to reduced or higher compensation for the advisor, and (d) why the annuity is the remarkable option for you. - Annuity accumulation phase

Of course, a consultant might try pressing annuities also if they're not the most effective suitable for your situation and objectives. The factor might be as benign as it is the only item they sell, so they fall prey to the proverbial, "If all you have in your tool kit is a hammer, pretty quickly everything begins looking like a nail." While the advisor in this scenario might not be dishonest, it boosts the danger that an annuity is a bad selection for you.

Fixed Annuities

Because annuities typically pay the representative offering them a lot higher commissions than what s/he would certainly receive for investing your cash in shared funds - Fixed annuities, let alone the absolutely no compensations s/he 'd get if you purchase no-load mutual funds, there is a large reward for agents to push annuities, and the more difficult the better ()

A dishonest advisor recommends rolling that quantity into new "far better" funds that just happen to carry a 4 percent sales tons. Concur to this, and the expert pockets $20,000 of your $500,000, and the funds aren't likely to execute much better (unless you selected even a lot more poorly to start with). In the exact same example, the consultant might guide you to buy a difficult annuity with that $500,000, one that pays him or her an 8 percent compensation.

The consultant tries to hurry your choice, declaring the deal will quickly go away. It might without a doubt, but there will likely be similar offers later. The expert hasn't figured out just how annuity settlements will certainly be exhausted. The advisor hasn't revealed his/her compensation and/or the charges you'll be charged and/or hasn't shown you the impact of those on your eventual settlements, and/or the settlement and/or charges are unacceptably high.

Existing interest prices, and hence projected repayments, are traditionally low. Even if an annuity is right for you, do your due diligence in contrasting annuities marketed by brokers vs. no-load ones marketed by the providing firm.

Who provides the most reliable Senior Annuities options?

The stream of regular monthly payments from Social Security is similar to those of a postponed annuity. In fact, a 2017 comparative evaluation made an extensive contrast. The complying with are a few of one of the most prominent points. Given that annuities are volunteer, the people buying them generally self-select as having a longer-than-average life span.

Social Security benefits are totally indexed to the CPI, while annuities either have no rising cost of living protection or at many offer a set portion yearly boost that may or might not make up for rising cost of living completely. This type of rider, similar to anything else that increases the insurance firm's risk, needs you to pay more for the annuity, or accept lower repayments.

What are the tax implications of an Tax-efficient Annuities?

Disclaimer: This write-up is intended for educational objectives only, and should not be considered economic recommendations. You should get in touch with an economic professional before making any type of significant monetary decisions. My job has actually had numerous uncertain spins and turns. A MSc in academic physics, PhD in experimental high-energy physics, postdoc in fragment detector R&D, research study placement in speculative cosmic-ray physics (consisting of a number of visits to Antarctica), a brief stint at a little design services business sustaining NASA, adhered to by starting my very own tiny consulting practice supporting NASA projects and programs.

Since annuities are meant for retired life, taxes and fines may use. Principal Protection of Fixed Annuities. Never ever lose principal due to market performance as fixed annuities are not bought the marketplace. Even throughout market recessions, your cash will not be affected and you will not lose money. Diverse Investment Options.

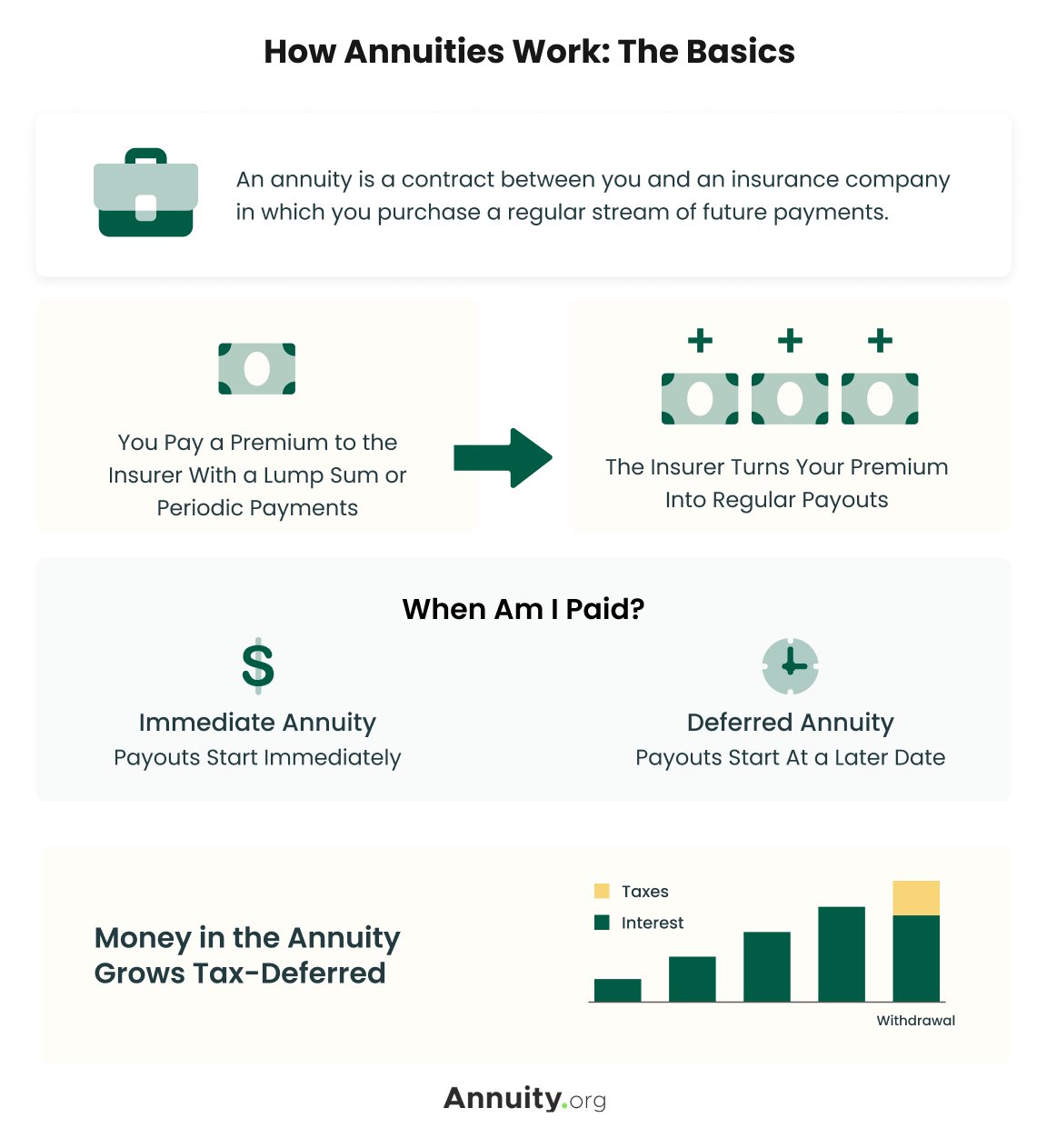

Immediate annuities. Made use of by those who desire trusted income instantly (or within one year of acquisition). With it, you can tailor earnings to fit your requirements and produce revenue that lasts permanently. Deferred annuities: For those that want to grow their money gradually, yet agree to postpone accessibility to the cash until retirement years.

Is there a budget-friendly Tax-efficient Annuities option?

Variable annuities: Supplies higher potential for development by spending your cash in financial investment options you select and the ability to rebalance your profile based upon your preferences and in a means that lines up with transforming monetary goals. With fixed annuities, the company invests the funds and supplies a rate of interest to the client.

When a death insurance claim happens with an annuity, it is essential to have a called beneficiary in the agreement. Different options exist for annuity death advantages, depending upon the contract and insurance company. Selecting a refund or "period particular" option in your annuity supplies a fatality advantage if you die early.

What is the most popular Deferred Annuities plan in 2024?

Naming a recipient aside from the estate can aid this process go a lot more efficiently, and can aid make certain that the earnings go to whoever the specific desired the cash to head to as opposed to experiencing probate. When existing, a survivor benefit is immediately included with your contract. Depending on the sort of annuity you buy, you might be able to add boosted survivor benefit and attributes, however there could be extra expenses or charges connected with these add-ons.

Table of Contents

Latest Posts

How can an Annuity Interest Rates help me with estate planning?

What is the best way to compare Deferred Annuities plans?

How can an Flexible Premium Annuities help me with estate planning?

More

Latest Posts

How can an Annuity Interest Rates help me with estate planning?

What is the best way to compare Deferred Annuities plans?

How can an Flexible Premium Annuities help me with estate planning?